Machine Learning for

Intelligent Asset Management

Algorithmica is a Swiss fintech company applying the principles of artificial intelligence to the financial markets.

What we offer

Solutions tailored to your needs

Ut elit tellus – luctus nec, luctus consectetur adipiscing elit tellus mattis pulvinar dapibus. Donec vestibulum, lorem a aliquam commodo, eros nisl pellentesque elit tellus!

Personal wealth management

Consectetur elit tellus, luctus consectetur adipiscing elit tellus nec ullamcorper dolor luctus consectetur.

Investor & fund management

Consectetur elit tellus, luctus consectetur adipiscing elit tellus nec ullamcorper dolor luctus consectetur.

Crypto currency operations

Consectetur elit tellus, luctus consectetur adipiscing elit tellus nec ullamcorper dolor luctus consectetur.

Financial consulting

Consectetur elit tellus, luctus consectetur adipiscing elit tellus nec ullamcorper a aliquam commodo consectetur dolor luctus ipsum amet.

Portfolio & asset management

Dolor amet, consectetur eadipiscing elit tellus nec ullamcorper tellus leo dolor for aliquam glavrida.

Bank metal

operations

Duis tristique id metus quis fringilla. Donec tellus leo, eadipiscing elit luctus consectetur tellus dolor amet.

Our firm

The principles of AI applied to the financial markets

Algorithmica is a Swiss fintech company applying the principles of artificial intelligence to the financial markets. Our continually evolving proprietary system delivers non-discretionary LOW-FREQUENCY optimized portfolios designed to generate consistent, stable, and uncorrelated returns to the benchmark indices.

Our Approach

Merging macro data with machine intelligence to power adaptive predictive portfolios

Our approach combines macroeconomic and fundamental variables to forecast price direction with consistency and accuracy.

Our machine learning system employs proprietary techniques that effectively solve the multi-dimensionality problem in large factor sets, enabling the integration of a wide range of factors within a unified analytical framework.

At the core, our system generates prediction engines on the expected return of individual liquid exchange traded financial instruments. These prediction engines cover weekly and monthly timeframes.

Portfolio construction is built by our system using these individual engines and optimized according to the strategies mandate; all asset selections, weightings, and gross portfolio exposures are controlled by our model.

Portfolios are optimized by our system to achieve specific objectives—maximizing the Sharpe ratio, minimizing drawdowns, or enhancing returns—with each optimization dynamically shaping the portfolio’s asset weightings.

Our DNA

Redefining systematic investing with AI-powered strategies that anticipate markets and deliver precision across global macro assets

At our core we are a group of applied researchers, mathematicians, programmers, web designers, and financial professionals who rely on statistics and mathematics to generate actionable prediction engines and portfolios geared for institutional investors.

Using decades of knowledge, we have developed a system unhinged from the traditional trend following and pattern recognition approach.

Our Difference

Redefining systematic investing with AI-powered strategies that anticipate markets and deliver precision across global macro assets

Algorithmica stands apart from its peers through its pioneering use of advanced computational intelligence to design, research, and implement investment strategies across global macro markets.

Every strategy originates from a unified machine learning framework that continuously refines and optimizes each approach toward its distinct objective.

Long before artificial intelligence became the industry’s buzzword in 2025, Algorithmica had already embedded AI-driven principles at the core of its investment philosophy—enabling it to transcend conventional approaches and redefine how systematic strategies are conceived and executed.

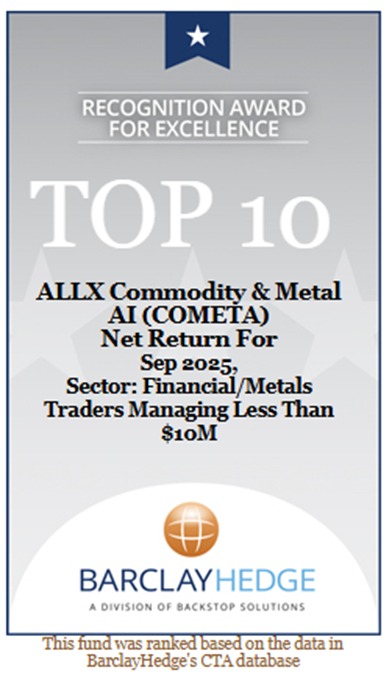

Our Awards and News

23/07/2025

Algorithmica Reports 35% Return in First Fiscal Year, Driven by Machine Learning Trading Technology

Algorithmica Reports 35% Return in First Fiscal Year, Driven by Machine Learning Trading Technology

01/10/2025

01/11/2025

Why customers love us

We’re here to relieve the stress of managing your finances

15,000+

satisfied customers

Competitive prices

Ut elit tellus – luctus nec, luctus consectetur adipiscing elit tellus mattis pulvinar dapibusadipiscing

Simple and transparent process

Donec vestibulum, lorem a aliquam commodo pulvinar dapibus luctus consectetur adipiscing glavrida.

Competent finance experts

Luctus consectetur pulvinar dapibus luctus consectetur adipiscing adipiscing elit tellus mattis pulvinar luctus luctus consectetur consectetur dapibus lorem ipsum.